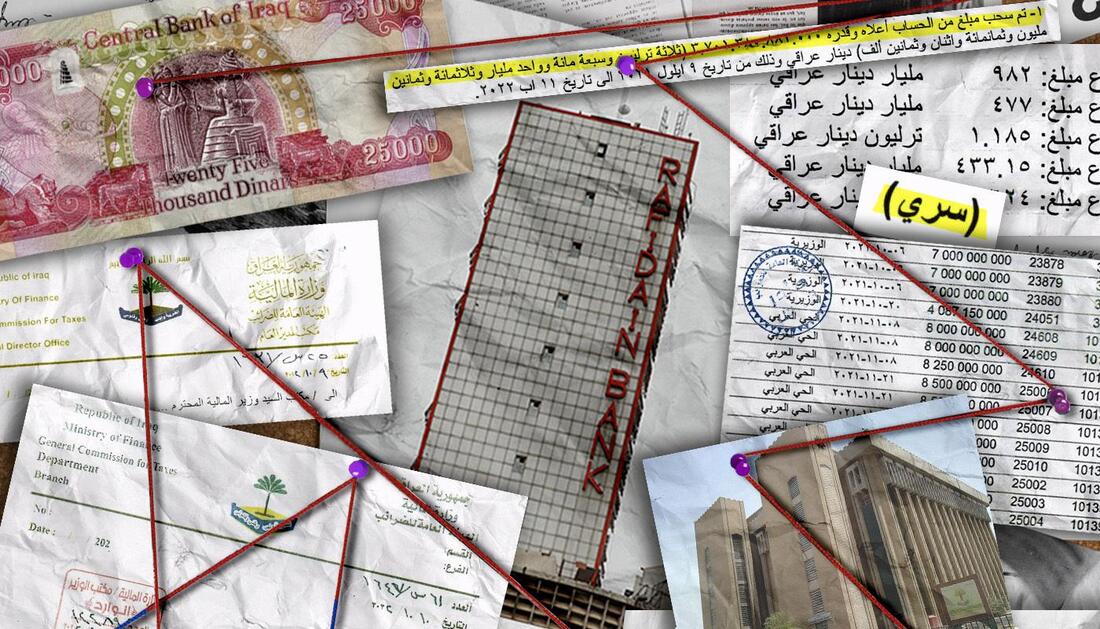

The report sets out the findings of an investigation by Iraq’s ministry of finance that uncovered how hundreds of cheques purportedly issued by the tax authority were cashed at branches of a state-owned bank between September 2021 and August 2022.

The investigation, launched in September by the country’s then-acting finance minister Ihsan Abdul Jabbar Ismail, concluded that almost 3.7 trillion dinars (about $2.5bn) had been stolen from the Iraqi General Commission of Taxes (IGCT).

The report was sent by the finance ministry to the Iraqi parliament’s finance committee last month but has not been made public.

It raises serious concerns of corruption or negligence involving senior figures at the tax authority, the state-owned Rafidain Bank, and within the wider Iraqi political system – with dozens of officials in different state apparatus facing charges over alleged theft or alleged facilitation of theft from the IGCT’s tax deposit accounts used to hold money paid in advance by companies against future tax liabilities.

It also suggests that the thefts were enabled by the removal of Iraq’s public spending watchdog, the Federal Board of Supreme Audit (FBSA), from oversight of tax deposit refund requests just weeks before the first cheques were cashed.

According to documents reviewed by MEE, this change was proposed by the then-head of the parliamentary finance committee.

It also appears to have been approved by a top official in the office of then-prime minister Mustafa al-Kadhimi, as well as by the heads of the IGCT and the FBSA.

Details of the thefts came to light following the resignation in August of the finance minister, Ali Allawi, in protest at what he described as endemic corruption in public finances.

In Allawi’s place, Kadhimi appointed Ismail, then also the oil minister, as acting finance minister.

MEE understands Ismail was told about the missing funds when officials discovered there was not enough money in the IGCT's accounts to cover genuine requests from companies for tax deposit refunds.

But Iraq’s parliament – at the recommendation of the finance committee – last month voted for Ismail to be removed from the finance ministry over alleged mismanagement just days after the ministry forwarded the report on the investigation.

In his resignation letter, which MEE has seen, Ismail blamed moves to oust him from the finance ministry on parties who he said wanted to stop the investigation into the missing tax money, and said that removing him from the post was in the interests of those who had profited from the theft.

The saga has unfolded amid wider upheaval in Iraqi politics. On 27 October, the parliament finally approved a new government led by Mohammed Shia al-Sudani after more than a year of deadlock since elections in October 2021 during which Kadhimi had remained in office as caretaker prime minister.

Speaking earlier this month, Sudani vowed to tackle corruption and called for the funds stolen from the IGCT to be recovered.

Those so far arrested or the subject of warrants include current and former officials at the IGCT, the finance ministry, Rafidain Bank, and the Federal Commission of Integrity (FCI), a regulatory body.

MEE understands they also include members of Iraqi intelligence, senior staff in former Prime Minister Kadhimi’s office, and a number of businessmen

'Reverse-tracking' the missing money

The classified report obtained by MEE reveals how a web of companies and related bank accounts was created to enable trillions of dinars to be stolen through fake cheques purportedly issued and then cashed for tax deposit refunds from the IGCT’s accounts at Rafidain Bank.

According to the report, the balance of the accounts at the time of the investigation should have been 3,531,501,702,289 dinars (about $2.4bn). But the actual balance was just 145,050,309,732 dinars ($99m).

Investigators said the money had been stolen using 247 cheques paid to five companies with accounts at branches of Rafidain Bank between September 2021 and August 2022.

All of the money was withdrawn from the banks as cash shortly after the cheques had been paid to the accounts. The scheme peaked in June 2022 when 45 cheques worth 775 billion dinars ($531m) were cashed.

“The robbers cancelled the entire documentation process for requests for tax refunds,” he said.

“All the cheques were issued without any documents, so we did not know what had happened until we started reverse-tracking the movement of money.”

Investigators discovered that none of the companies to whom the money was paid had any tax deposits to reclaim. Some of the companies had been created just weeks beforehand, and all five company accounts held by Rafidain Bank were opened shortly before they were first used to cash the cheques.

The five companies which cashed cheques were Al-Qant General Contracting Company, Al-Mobdioon Oil Services Company, Al-Hout Al-Ahdab General Trading Company, the Badiat al-Masaa Company, and the Riyah Baghdad Company for General Trading.

Al-Qant cashed cheques totalling almost 1.2 trillion dinars (around $812m) between September 2021 and August 2022.

According to the report, the first cheque, worth more than 44 billion dinars ($30m), was paid into Al-Qant’s account at Rafidain Bank on 9 September 2021, just two days after the account had been opened.

Al-Hout Al-Ahdab cashed cheques worth 982 billion dinars ($673m), Badiat al-Masaa cashed 624 billion dinars ($428m), Riyah Baghdad Company cashed 477 billion dinars ($327m), and Al-Mobdioon cashed 433 billion dinars ($297m).

The report names a businessman, Noor Zuhair Jassim, as the CEO of both Al-Qant and Al-Mobidoon companies. Jassim was arrested last month at Baghdad International Airport. MEE was unable to reach Jassim for comment but understands he is still in custody.

The three other companies were all established in July 2021 and all share the same CEO, named in the report as Abdul Mahdi Tawfiq Mahdi, a 68-year-old businessman. Mahdi has been released on bail but his whereabouts are unknown and MEE was unable to reach him for comment.

All three companies opened bank accounts in November 2021, about six weeks before cheques were paid into the accounts.

Bank statements up to September 2022 for the five companies seen by MEE show that no deposits were paid into the accounts other than the cheques from the IGCT. Most of the money was withdrawn in cash on the same day it was deposited.

Officials involved in the investigation told MEE the withdrawal of such large amounts of cash – on some days totalling 90 billion dinars ($61.7m) – should have set alarm bells ringing.

“Withdrawing such huge sums in cash, not only draws attention, but is considered a disaster in the banking sector,” said an advisor at the finance ministry.

“Money for a bank manager is like a child that has to be cared for and protected. Allowing such amounts to be withdrawn over a year without the bank manager opening an investigation, or informing the minister of finance or the Central Bank, is an unforgivable and unjustifiable sin.”

MEE contacted the finance ministry, which also handles media queries relating to Rafidain Bank. But the ministry declined to comment because it said the case is still under investigation.

How the watchdog was sidelined

According to the report, one of the main reasons why the thefts were not detected earlier was that Iraq’s public spending watchdog, the FBSA, which had previously been responsible for auditing tax deposit refund requests, had been removed from this oversight role in August 2021, just weeks before the first cheque was cashed.

"The FBSA was the biggest obstacle faced by the thieves, so they worked to remove it," a senior Iraqi official familiar with the investigation told MEE.

The FBSA oversees the financial accounts of ministries, government departments, and independent public bodies.

In 2017, then-Prime Minister Haider al-Abadi tasked the FBSA with auditing requests to refund tax and customs deposits. Abadi told MEE this was necessary to “reduce manipulations” of the system.

In July 2021, however, Haitham al-Jubouri, who was then the head of the parliamentary finance committee and later became an advisor to Kadhimi on financial policy, sent a letter to Ali Allawi, the finance minister, urging him to reverse this move.

Jubouri told Allawi his committee had received complaints from companies frustrated that payment of tax refunds was being delayed by the FBSA’s scrutiny of the process.

Jubouri wrote: "With the aim of mitigating the procedures... we suggest that the IGCT conduct the audit procedures... and limit the role of the FBSA to its basic tasks stipulated in its law.”

Copies of the letter were sent to the heads of the FBSA and the IGCT.

In a statement, Jubouri told MEE his proposal had only made the point that Iraq’s financial management law “did not mention any role for the FBSA to disperse tax trust deposits”.

He said responsibility for the subsequent change to the auditing arrangements rested with the IGCT.

“Those who stopped the audit were [carrying out] the directives of the IGCT… not the proposal we submitted,” said Jubouri.

Jubouri’s letter appears to have set in motion a chain of events that led to the shift in responsibility for auditing tax refund requests from the FBSA to the IGCT.

In a letter sent to Kadhimi’s office on 27 July, the head of the FBSA expressed support for Jubouri’s proposal and asked whether the watchdog should continue to audit tax refund requests.

Jubouri’s proposal then appears to have gained the backing of Raed Jouhi, the head of Kadhimi’s office.

According to documents seen by MEE, Jouhi instructed Ibrahim al-Zubaidi, the prime minister’s legal adviser, to write to the FBSA, the IGCT, and the General Customs Authority in support of the proposed reduced role for the FBSA.

In his letter, however, Zubaidi advised them only to "do what is necessary in accordance with the law", citing articles of the financial management law and another law relating to the work of the FBSA.

Neither of the laws cited by Zubaidi appears to provide any statutory basis for removing the oversight role of the FBSA in regard to tax refund requests, MEE found.

In fact, in law, the FBSA has a broad remit to audit all aspects of public finance.

MEE contacted both Jouhi and Ibrahim al-Zubaidi for comment but got no response.

According to further correspondence and documents reviewed by MEE, Zubaidi’s letter nevertheless appears to have been taken as approval by top officials at both the IGCT and the FBSA to halt the auditor’s oversight of refund requests.

On 2 August, the director general of the IGCT, Shaker Al-Zubaidi, ordered officials to begin work to adopt the new auditing procedure that he said had been approved by Kadhimi’s office and the FBSA.

Zubaidi left the IGCT days later, moving to another role within the finance ministry in the customs department. When contacted for this story, Shaker al-Zubaidi referred MEE to his media advisor who declined to comment.

By the end of August 2021, Allawi was facing mounting pressure to remove the FBSA from the process of auditing requests for tax deposit refunds and finally agreed.

Within weeks millions of dollars were being siphoned unnoticed – and yet withdrawn as cash at branches of Rafidain Bank – from the IGCT’s account.

‘Secret networks’

Allawi denounced the contract as corrupt, describing the case as "the straw which broke the camel's back" and citing endemic public sector corruption.

Asked why he had agreed to the removal of the FBSA from its oversight role, Allawi told MEE: “My approval was based on the request of the legislative authority represented by the finance committee of the former parliament, the approval of the FBSA and the prime minister's office, as well as the request of the IGCT."

Allawi said he had nonetheless put other auditing processes in place, and suggested that the FBSA’s scrutiny of tax deposit requests would not have been enough to stop the theft of the tax authority’s money – because the thieves had left no paper trail for auditors to follow.

"The existence of the FBSA would have made [the thieves] think twice before doing this, but it [the FBSA] would not have discovered the theft," he said.

RSS Feed

RSS Feed