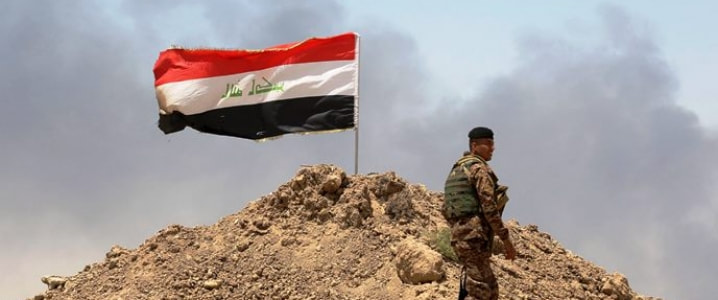

At the same time that a new Iraqi government is forming, a government that is increasing Iranian influence within Iraq, another election is threatening the country’s stability.

On Sunday, Kurdistan is voting for a new KRG parliament, a vote that may result in new power brokers in Erbil. The Kurdish elections are hugely significant for the region, as they not only decide who is going to be put forward as the potential president of Iraq, but also reshape the KRG as an entity and its relations not only with Baghdad, but also with Iran and Turkey.

A further destabilization of Iraq would be an outcome that most regional players aim to avoid, with the war in Syria and the imminent Iranian sanctions already causing uncertainty.

Optimistic statements made by Iraqi oil officials have normally been taken with a grain of salt, but now it seems that the media accepting the narrative without question. While protests in the Basra Province have been well covered, almost no attention has been given to the dramatic shifts going on in Baghdad. After a short period of anti-Iranian political rhetoric and even a highly publicized visit to Saudi Arabia, Muqtada Al Sadr, the leader of the strongest Iraqi Shi’ite party, seems to have done an about turn politically. This is important because the outcome of the current Iraqi power struggle will have an effect in the coming months on the possible revamp or expansion of the oil production capacity. With this in mind, the Kurdish election become increasingly important.

Iraq’s oil ministry has said that oil production from its northern Qayara oil field, which until last year was shut-in due to Daesh/IS, is currently ramping up production, aiming to reach a level of 60,000 bpd by the end of 2018. Current production is slated to be around 30,000 bpd. Officials have claimed that this oil is already being exported by Iraq's State Oil Marketing Organization (SOMO).

The crude is being marketed at present to Iran or Turkey. According to Iraqi sources, the field, which is located south of the Ninewa province in northern Iraq, still holds 1.52 billion barrels in proven reserves of very heavy oil of around 15-18 API degrees. Since a force majeure, the current operator of the license, Angola’s Sonangol, has not been producing. In June 2014, IS/Daesh took the field and held it for two year. Sonangol eventually resumed work at the end of 2017, drilling more wells and increasing production to around 30,000 bpd

The failed bid for independence last year is still putting immense pressure on the historical power brokers in Kurdistan. The parliamentary election on Sunday could put an end to the delicate balance of power that has been pivotal to the stability of the country in recent decades, even during Saddam Hussein’s reign.

Analysts still expect the two main Kurdish parties, the Kurdistan Democratic Party (KDP) and Patriotic Union of Kurdistan (PUK), to control the outcome of these elections. There are, however, some splits within the PUK, which could lead to Masoud Barzani’s KDP taking a dominant position in Kurdish politics. Barzani is also likely to have a decisive influence on the formation of the federal government in Baghdad. Barzani has come under pressure from Baghdad, however, as he was leading the call for independence in 2017.

Kurdish voters are expected to play a significant role in the elections as Baghdad has taken some territories from the KRG, limiting the region’s economic autonomy. Baghdad will be watching Sunday’s election carefully. Both the KDP and PUK will be aiming for victory, with a view to filling the post of the federal president of Iraq. It is not yet clear what position the KDP or PUK will take in regard to a more hardline pro-Iranian Shi’a government in Baghdad. Interestingly, the Turkmen minority in the KRG has already stated that it will be joining, via the Iraqi Turkmen Front, the Reform and Reconstruction Coalition, which is supported by Shiite leader Muqtada Al-Sadr. This coalition is made up of the Saeroon bloc supported by the leader of the Sadrist Movement, Muqtada Al-Sadr (54 seats out of 329), and the Victory Alliance led by Al-Abadi (42 seats).

Al Sadr changed his political affiliations after a meeting in Beirut with Hezbollah's Hassan Nasrallah and Iran's Quds Force leader Qasem Soleimani. The three are reported to have agreed on a compromise candidate for Iraq's next prime minister. Araba news media indicated that the likely candidate for Iraq's premiership is Adel Abdul Mahdi, the former head of the Ministry of Oil and Ministry of Finance and a one-time vice president of the country. He seems to have been given the support of the Sairoon Alliance of Shiite cleric Muqtada al-Sadr and the Fatah Alliance of Hadi Al Amiri. The latter is of great concern to international observers and Western-Arab governments. Al Amiri leads Iraq's Popular Mobilization Units currently, which have Iran's backing. If this alliance of convenience is going to appoint the new PM, reaction from the U.S. and Arab countries could be harsh. At present, Washington still favors the current PM, Haider Al Abadi – who has come under severe pressure due to allegations of fraud and misconduct.

At the same time, Arab countries, especially Saudi Arabia, the UAE and Egypt, will be worried about the Muqtada Al Sadr move to support the Iranian-Hezbollah backed Adel Abdul Mahdi. The direct connections with the Iranian backed militias and the ongoing power struggle between the Arab Alliance and Iran could lead to a possible confrontation. At present, Tehran seems to have the upper-hand in the Shi’a led country, able to pursue its goal of further integrating the Iranian and Iraqi economy, and building up a Shi’a power base in the region, linked with Syria and Lebanon. The fact that this new alliance has come after a meeting with Hezbollah chief Hassan Nasrallah and Iranian hardliner Maj. Gen. Qasem Soleimani, the commander of Iran’s special forces unit, Quds Force, is worrying. It seems that Iraq’s moderate but supreme religious leader Grand Ayatollah Ali al-Sistani has also given his blessing to the new alliance. The significance of this blessing for relations in the region remains unclear. Some have said that it is an obvious Shi’a move to block U.S. interest in Iraq, and also to counter possible actions by Washington or the Riyadh-led Arab Alliance against Iran.

A deepening cooperation between a possible new Iraqi government and Iranian hard-liners will not only affect the regional constellation but will also have repercussions for Iran’s position within OPEC. Based on current developments, Iraq will not be blocking any Iranian attempts to circumvent U.S. sanctions or support OPEC-Russian moves to fill supply gaps after the full implementation of sanctions on Iran.

Tehran could even set up a framework in which Iraqi volumes would be swapped internally with Iranian exports to Baghdad. This strategy would only become clear if there is a sudden export increase from Iraqi parties in the coming months. At present, Baghdad is able to export around 3.583 million bpd from the south, aiming to reach 4 million bpd the coming months.

It is unclear if Iran and Iraq have considered the possible negative reactions of anti-Iranian forces if a closer relationship between the two comes to fruition. The still simmering anti-Iranian feelings in major regions of the Shi’a provinces in Iraq, combined with a possible re-emergence of Kurdish power, is a real threat to Iraqi oil production.

On top of all this, the continuing malpractices and misconduct of Shi’a militias, corruption in the government, and the overwhelming presence of Iran in Iraq is driving unrest in the Sunni controlled areas again. Sunni extremism has already been shown to have a fertile breeding ground in Iraq, with Al Qaeda and Daesh the most recent examples. Continuing division and religious cronyism will only lead to a re-emergence of violence in the south and instability in the north. Oil production and exports on both sides of this geopolitical chasm could be significantly impacted, especially if U.S. sanctions on Iran spread to include Iraq.

Source: oilprice.com/Geopolitics/International/Iraq-A-Ticking-Time-Bomb-For-Oil-Markets.html

RSS Feed

RSS Feed