The cost of such a facility could well be equivalent to the sum of $10 billion mentioned in the February agreement, possibly in the range of $7-$15 billion, based on similar Chinese backed ventures in Pakistan and Saudi Arabia, while the Nasiriyah Integrated Project (NIP – a linked-oilfield development and 150,000 bpd refinery) has an estimated cost of $9 billion.

The Nasiriyah case is instructive of how the Fao MoU could stumble before becoming reality, and highlights the importance of aligning the goals of Chinese refiners to enter growing markets, while meeting the goal of the Iraqi government to double refining capacity. NIP, originally a 300,000 bpd project, repeatedly failed to gain investor interest not only because of cheap subsidised fuel, but because, as Iraq Energy Institute Fellow Robin Mills has written, linking field development with refining “obscures the economics of the separate parts of the project.”

In the end, Chinese firms PetroChina and CNOOC declined involvement in NIP. The point here is that Chinese firms will be looking closely at the economics of these projects and may not have a significantly different outlook to Western companies wanting to enter the Iraqi refining market. In the past, this may have been different, but Chinese state-owned refiners are changing, while the BRI may be entering a new, more cautious phase.

As with Oman’s Duqm industrial park, a Chinese-led project with a refinery could become part of a bigger industrial zone. But the BRI initiative is still in early days and if past indications are anything to go by, (at least among oil exporters) energy will be a paramount part of future cooperation.

Downstream Ambitions & Challenges

In April 2018, Iraq signed MoUs with Norinco and Powerchina, to construct a 300,000 bpd oil refinery and petrochemicals facility in Fao. While Iraq urgently needs to create jobs across multiple sectors, the country also has a rapidly growing demand for refined fuel, with plans to increase refining capacity 1.5 mbpd by 2021, more than double the existing capacity of 600-700 kbpd.

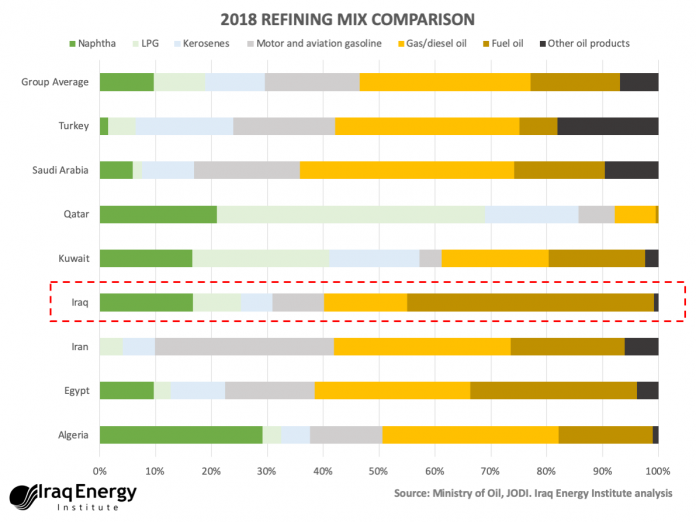

Despite the positive progress restoring 70 kbpd by rehabilitating units in Baiji, the loss of its nameplate capacity of 290 kbpd during the ISIS conflict erased 30% of Iraq’s refining capacity. Another factor accelerating the urgency to repair and expand refineries, is an annual $2-2.5 billion spending bill on importing petroleum products in Iraq. Basra and Doura refineries, the country’s largest operating facilities now at 200 and 140 kbpd respectively, are working at full production. The Ministry of Oil has limited options with upgrading existing smaller refineries. Most of Iraq’s fleet is dominated by primary distillation.

The HFO surplus provides an opportunity too, small to medium capacity upgrading and hydrotreating units can be used for creating highly needed lighter products. The IEA forecasts that Iraq will double its refining runs by 2030 and become self-sufficient. However, for now, the main challenge remains economic as it is unclear whether investors will simply be paid a conversion fee or be allowed to sell at own prices in Iraq’s subsidized retail market. Another uncertainty is the agency to export surplus or uncontracted output.

BRI Refining Ventures

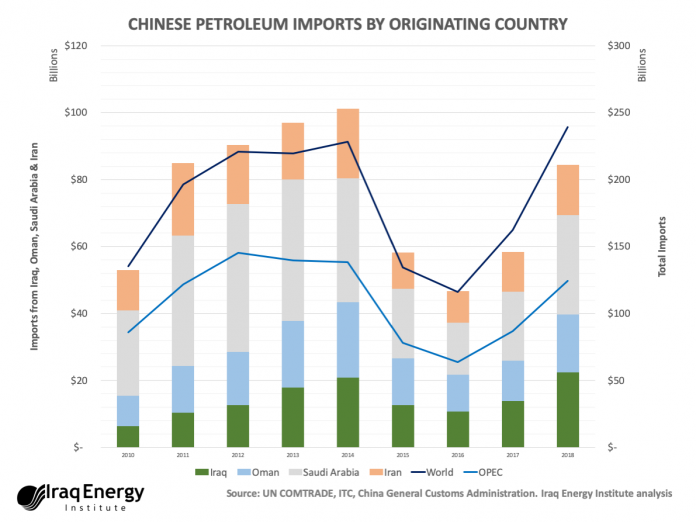

Refining projects under the BRI umbrella are either similar to the “Go Out,” policy whereby China helps build new energy infrastructure abroad or can lead back to projects in China based on long term fuel supply arrangements, such as a February 2019 MoU to build a $10 billion, 300,000 bpd refinery and petrochemical complex in northern China, part of a 2017 Norinco-Aramco venture.

Previously, the joint venture Yanbu Aramco Sinopec Refining Co (Yasref) collaborated onthe 400,000 bpd Yanbu oil refinery with $4.7 billion in international loans. Aramco also has a 25% stake in the Fujian refinery with Exxon and Sinopec signed an MoU with Zhejiang Petrochemical for a 400,000 bpd refinery at the end of 2018.

Aramco will also have a 9% stake in the colossal 800,000 bpd integrated refining and petrochemicals project at Zhoushan, part of an agreement where Aramco will provide much of the crude to the installation which will be operated by the Zhejiang Petrochemical company.

These deepening ties are undergirded by deep pockets in Beijing and Riyadh. However, the financing of Yanbu from a wide array of sources makes it more of a commercial project than a typical BRI strategic energy project. The days when Chinese state-owned energy companies were supported financially to the hilt, a policy guided by geopolitical considerations, may be coming to an end.

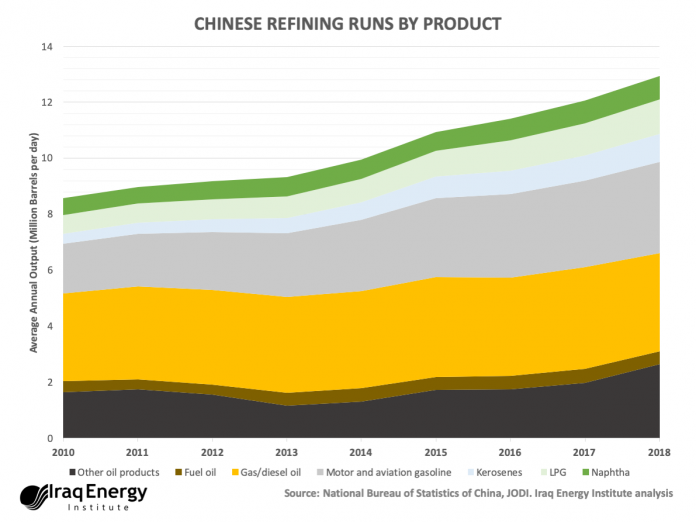

A recent survey of 20 Chinese refiners shows two new mega-refineries entering the Chinese market with a combined capacity of 800 kbpd in Q3 2019 and other existing maintenance by then. China’s refining runs have reached 12.68 mbpd in 2018 (Figure 2) and are expected to reach 13 mbpd by the end of this year.

Growing Chinese experience with these projects could lead to an inevitable boost to the learning curve for Chinese downstream ventures, exposing Chinese refiners to higher standards in the sector.

New Regulations

Domestically, China’s National Development and Reform Commission (NDRC) is toughening up regulations for Chinese refineries, imposing much stricter safety and environmental regulations. In 2017 for example, Sinopec’s pledge to spend $29 billion upgrading refineries to meet new sulphur regulations was a monumental development in the industry. Much more investment is in the pipeline as the big state-owned refiners meet the new China VI fuel emission regulations.

Following on from this, more Chinese refineries are upgrading their alkylation process units to those using Ionikylation , a relatively new process developed in Canada, increasingly with Chinese R&D input. Also on the environment front, Chinese refineries increasingly use the latest slurry phase hydrocracking units such as KBR’s Veba Combi-Cracker (VCC) units, the technology deployed in the CNPC – Cambodia Petrochemical Company’s 100,000 bpd refinery in Sihanoukville, as well as ENI Slurry Technology used by Sinopec.

Looking further afield, China is deepening cooperation with Western firms for megaprojects, adding another layer of risk assessment and external expertise to ventures.

Iraq could benefit from this new era, but every transition carries risk and much will depend on how projects like the Fao refinery are funded. Moreover, whether Iraq is seriously considering to open up the retail side for foreign investors by streamlining land ownership, leasing and petrol station chain creation processes.

Beyond China’s own changing regulations, Beijing’s investment in downstream projects is moving away from risk-laden domains to areas with a more developed regulatory environment.

In October, it was announced that Sinopec was partnering with Canadian consultancy Stantec for a 167,000 bpd refinery in Alberta, hoping to gain from the 2020 IMO regulations that may require a doubling of refining of heavy oil.

While this project has not been approved, more commercially orientated energy projects are not new for China, contrary to the perception that national interests drive China’s energy projects.

For example, Meichal Meidan has described how in the 80s and 90s, CNPC, Sinopec, and CNOOC expanded foreign investments following a reduction in state funding for domestic projects. Profitability has been on the horizon for Chinese IOCs for some years, despite reports of financial difficulties experienced by some of the oil and gas SOEs.

Pre-BRI road bumps, complicated politics

As noted, China now has a long experience working in high-risk domains with significant financial and political uncertainty. In the past, China has sometimes offered sweeteners on oilfield deals, such as the offer of a refinery to the Sudanese government in 1997, which became a 50-50 venture between CNPC and the Sudanese National Petroleum Company.

This was attractive to Sudan, which could secure the refinery against future oil revenues, rather than paying a high cost for refined fuel or looking for investment elsewhere. Of course, this would prove a dangerous strategy if the state acted wastefully with oil revenue. In the long run, the Khartoum refinery fell victim to wider economic problems within the country following the 2011 secession of South Sudan. In 2016, maintenance was delayed for two years as the country fell into a financial crisis. Chinese workers reportedly left the site due to safety concerns, but it has since gone back online.

In Chad, the Djarmaya refinery which is 60% owned by CNPC International (the venture began in 2009) was briefly shut down in 2011 and 2013 following disputes over fuel pricing. Relations between Chad and CNPC deteriorated, leading to a $1.2 billion fine levelled against CNPC by the Chadian Ministry of Environment, a move some content was based on politics rather than concern over pollution.

A more well-publicised case has been the Kara-Balta oil refinery in Kyrgyzstan, a venture with the Shaanxi Coal and Chemical Group launched in 2009. This project ran into a geopolitical roadblock involving conflicting interests in Kyrgyzstan, Russia and China, but was also stymied by the complex investment environment in Kyrgyzstan.

In Nigeria, 2010 saw a $23 bn framework agreement between the Nigerian National Petroleum Company (NNPC) and the China State Construction Engineering Corporation (CSCEC), but the three refineries that were to follow never came into existence as oil prices plummeted, while Nigeria failed to remove subsidies and concerns were raised with the governance of NNPC. The above projects were all pre- BRI, and it is increasingly evident that the Chinese government and business community want a new approach to risk assessment following these setbacks.

These projects, and others along the BRI, have drawn much criticism, which has been well documented elsewhere; Beijing has responded publicly while also claiming that project risk assessments are being strengthened and projects are involving more international investors. At the highest level, Beijing has demanded more detailed project assessments following early BRI setbacks. This is increasingly the case in the downstream sector.

Elsewhere, the last four years have seen a number of Chinese refining ventures in countries that would struggle to finance these projects without massive external assistance. In Venezuela, oil refining partnerships have straddled the pre-BRI and Xi Jinping eras, seeing Venezuela’s state oil company PDVSA partner with Chinese companies to build refineries for the country’s Merey 16 crude blend. Focused on a strategic alliance rather than a commercial partnership, three of the ventures totalling a potential 800,000 bpd, have not gone ahead due to PDVSA’s inability to supply crude.

On January 31st, it was reported that the venture China-Venezuela Guangdong Petrochemical Co Ltd, comprising PDVSA and Petrochina, had parted ways after the Chinese became concerned about the 400,000 bpd project.

Going forward

China’s increasingly regulated refining sector, combined with growing commercial confidence to operate in G20 countries, could represent a genuine opportunity to build new refining capacity in Iraq. Both governments must first ensure that terms are sustainable and that the kind of stumbling blocks that have delayed major Iraqi projects such as the Karbala refinery are removed well in advance.

Because China appears increasingly cautious about extending cheap lines of credit, even to build strategic relationships or secure oil supplies, both sides must work together to assess project viability.

Even as recently as 2016, the promise of rapid finance from Chinese state banks has swayed governments, including Uganda, to partner with Chinese companies on refining projects, taking on debt risk. As in Sudan, one potential deal involved access to oil fields, (in this case the IOC was CNOOC.) The Chinese company contracting to build the $4 billion Ugandan refinery reportedly wanted a sovereign loan guarantee, exposing the government to significant financial risk if the project failed, and wanted to restrict Ugandan hiring to 40% of the project workforce, terms which would possibly be unacceptable in Iraq due to the 2007 Iraqi refining law. Similar deals in Iraq will require careful economic analysis.

That said, the $10 billion Chinese financing agreement allocates 1.5 billion for borrowing by the Iraqi government. Also, it relieves Baghdad from providing sovereign guarantees, equivalent to 15% of a project’s cost, if a Chinese firm is investing. These terms may alleviate risk on both ends.

Looking to the near future, Ethiopia, which has seen major Chinese investment, provides an example Iraq might be able to follow in the downstream sector. The planned 120,000 bpd Awash refinery near Addis Ababa is more financially viable due to the country’s efforts to eliminate fuel subsidies, while 50% of the fuel will be exported, attracting potential South Korean and Indian investors.

In any case, the economics of any project, whether it is an Iraqi-led initiative, a Western-led one or a Chinese led one, are not immune to market forces.

Source (Click Here)

RSS Feed

RSS Feed