In late 2002, Jeremy Heywood, then principal private secretary to Blair, discussed using “a change of regime” in Iraq to flood the global oil market as a policy option, the papers reveal.

In an official memo, Foreign Office officials also suggested encouraging Venezuela or Nigeria to leave the group of petroleum exporting countries as a way of bringing down the price of oil set by Opec.

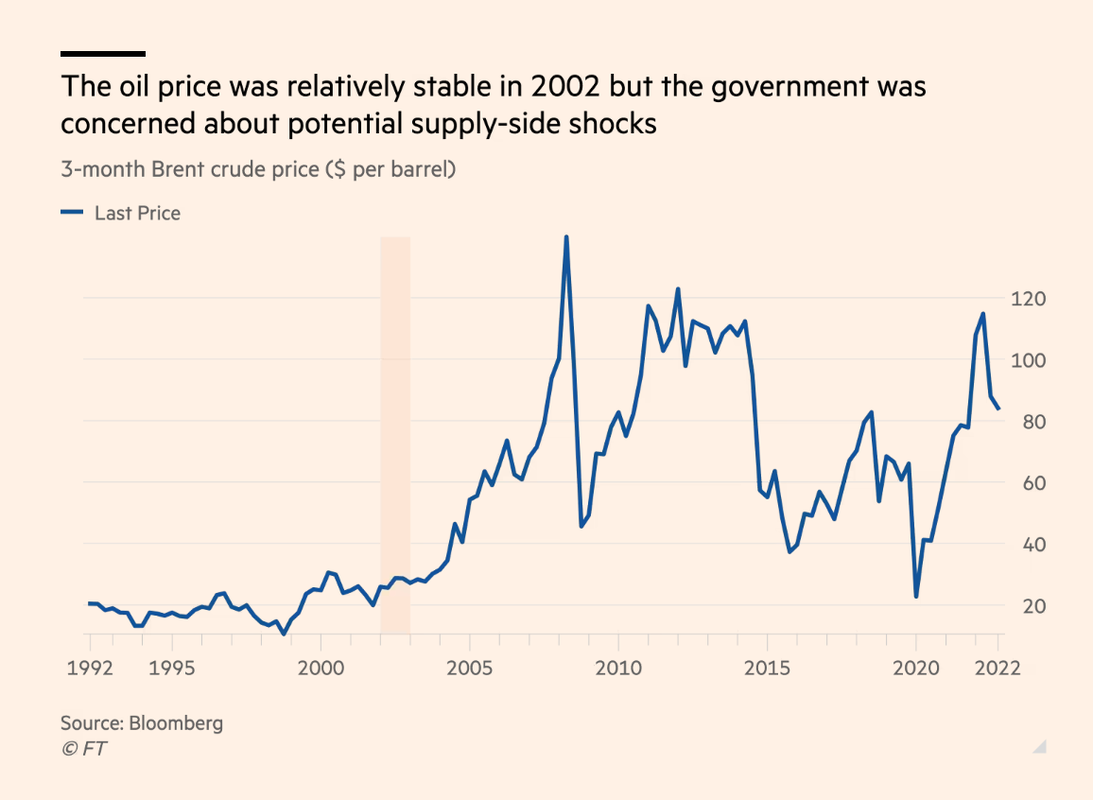

At the time, the New Labour government was concerned by the rise in oil prices as the global economy teetered on the brink of recession after the dotcom crash and the September 11 terrorist attacks in the US.

The UK was also concerned by the potential for a supply-side shock resulting from a US invasion of Iraq, which by November it was supporting in principle.

Opec, which represents around a third of the world’s oil production, aims to regulate global oil prices by balancing the supply of its member countries.

It had pledged to keep the oil market well supplied in the aftermath of September 11 in 2001. But as the global economy slowed, Opec confirmed a 6.5 per cent cut in oil production in December.

Opec had 10 voting members in 2002. Russia is not a member although it has taken part in voluntary oil price cuts as part of a looser Opec+ grouping since 2016.

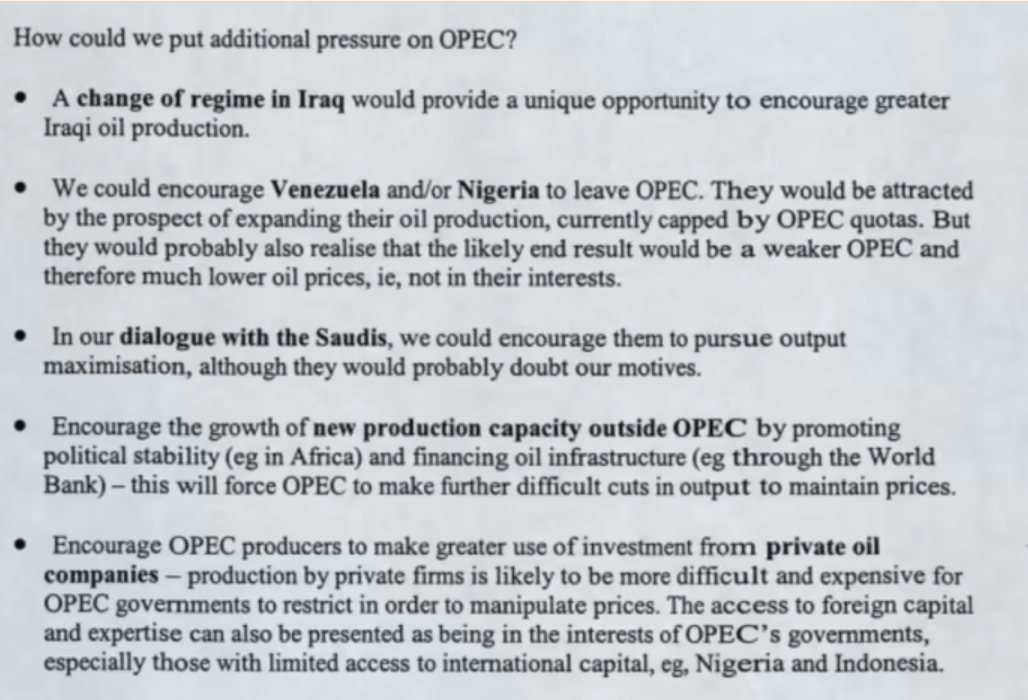

In an informal government memo titled “Could or should we break Opec?” from November 2002, Michael Arthur, then director-general for Europe and economic affairs at the Foreign Office, wrote to Heywood that the UK could “seek to undermine Opec cohesion in a number of ways”.

In the memo, Foreign Office officials referred to the “unique opportunity” from regime change in Iraq to encourage greater oil production in the country over a period of “five [to] eight years”.

The document also suggested incentivising Venezuela or Nigeria to leave Opec, and sewing division within the group by suggesting to Saudi Arabia that it push to increase its production quota, which could lead to other members receiving less market share.

An oil producing country that left the cartel would be free to sell more than its agreed quota.

This could increase the supply on the global market, forcing Opec to cut its production in order to maintain its preferred price.

In an annotation on a Treasury briefing note about Opec’s decision to maintain the oil price, dated to September, Heywood wrote “very very bad for the world economy”, indicating senior officials’ anger towards the situation.

“We really do need to accelerate work on reducing reliance on Opec by establishing long-term fixed price contracts with Russia.” Officials also concluded that too low an oil price would, in the long run, harm British interests as it risked economic and political disruption in volatile regions such as Russia and the Middle East.

Brent crude oil started 2002 at $19 per barrel, before rising to reach $31 per barrel in January 2003 and $147 per barrel by July 2008.

RSS Feed

RSS Feed